How To Make Money In Stock By William O Neil

"You are not trying to buy at the cheapest price, but at the time when the stock has the greatest probability of going up in price." - William O'Neil How to Make Money in Stocks: A Winning System in Good Times and Bad

Growth or value? Should investors buy stocks after they fall because they're "cheap?" Or should they buy rallying stocks with the expectation they'll rise more? This week we'll consider the answer in How to Make Money in Stocks: A Winning System in Good Times and Bad by William O'Neil.

O'Neil's classic book answers in favor of strong, upward-trending stocks. It includes 100 charts dating back to the 1880s, analyzing price action to find patterns that increase the odds of success. Key things to watch for and to avoid are outlined.

Cup & Handle Patterns

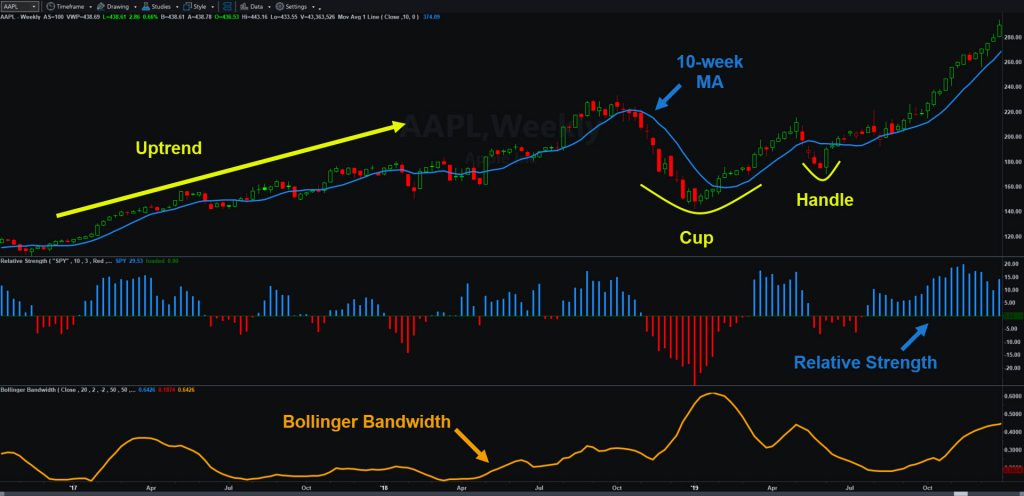

O'Neil is known as an advocate of the "cup-and-handle" chart pattern. This is when a stock has been rallying and pauses for about three to six months. (The "cup.") The goal is then to buy shares as they exit the pattern ("handle") and hold as they proceed to make new highs.

The first thing to look for technically is a longer-term uptrend. Cup and handles are continuation patterns (not reversals). Therefore you need to see a history of rising prices before the sideways consolidation occurs. This is important because some downward-trending stocks may have patterns resembling a cup and handle. For example: General Electric (GE) between February 2019 and July 2019. O'Neil absolutely does not mean to include stocks like this.

The second thing to look for is a tight consolidation period. This often resembles a basin or saucer.

Tightness matters because it shows the stock is merely resting and not going through an existential crisis. It's also consistent with ongoing purchases by large institutional investors — another theme in O'Neil's book.

The third, and most important thing, is the breakout. A stock should form a tight flag pattern in the upper half of its cup and above its 10-week moving average, according to O'Neil. Investors should look to buy shares around this time — especially if volume increases.

O'Neil on Fundamentals

How to Make Money in Stocks covers more than just charting. It also places heavy emphasis on fundamentals like earnings, sales growth, management and products. This part of the book is complex and should possibly be read more for general principles than hard-and-fast rules.

The reason is that quarterly results don't always play out as exactly as described. However the basic ideas are sound. Here's are my summary of O'Neil's the key lessons on fundamentals:

- There's no substitute for growth. Investors want to see companies that are getting bigger.

- Products matter. Even if you don't use a company's product in your ordinary life, it should be innovative and offer growth potential.

- Management teams matter. Look for entrepreneurial and visionary executives with a feasible long-term growth plan. Avoid "caretakers" and "maintainers."

- Cheap isn't good. Buying stocks because they're down is usually a bad idea. O'Neil encourages readers to overcome their initial fear of buying stocks that may have already appreciated considerably.

- Relative strength matters. Stocks outperform the market for a reason.

- Follow institutional investors. Large money managers usually know more than the average retail investor. They also tend to buy steadily over time. O'Neil suggests looking for stocks with large institutional support.

- Don't fear new companies that aren't yet well known. One day they may be household names.

Limitations of How to Make Money in Stocks

O'Neil's book is excellent and worth reading because it outlines key principles of growth investing demonstrated by dozens of examples. However it has limitations.

The first limitation O'Neil himself acknowledges:

"If you are reading this book for the first time near the beginning or middle of a bear market, do not expect the presumed buy patterns to work. Most of them will definitely be defective. You absolutely do not buy breakouts during a bear market. Most of them will fail."

Another problem is that O'Neil focuses heavily on individual companies rather than sectors. This might work for innovative technology firms, but there clearly are times that entire sectors move in tandem. For example, energy stocks, airlines and gold miners have had coordinated gains or losses because of the coronavirus pandemic.

These usually result from broad macro forces like the economy, politics and monetary policy. O'Neil mostly overlooks these big-picture issues.

The third drawback of How to Make Money in Stocks is that it's too specific on the specific financials of a growth company. It focuses almost exclusively on income-statement items like revenue and profit.

However, stocks often climb on hopes of future growth — long before it hits the income statement. Tesla (TSLA) is an example of that trend. Investors may want to focus instead on volumes, which are expressed in orders/subscriptions and unit sales. These become revenue in the future.

An alternative is to target companies with book-value growth (based on the balance sheet). This finds businesses whose assets are growing faster than their liabilities. It's another characteristic of growth that O'Neil overlooks.

Readers may find two other parts on the book less useful:

- O'Neil's chapter on market direction is simplistic and may not consider enough factors (like investor sentiment, volatility and breadth.)

- O'Neil's advice on portfolio management may not be suited for all investors.

Applying TradeStation's Tools

TradeStation's award-winning platform can help you apply O'Neil's principles.

First, you can discover potential stocks with Scanner or RadarScreen. (Check out this webinar on August 18 for more.)

Second, your charts can show relative strength. Click on the "studies" menu option to add.

Third, you can spot periods of tight consolidation with indicators like Bollinger Bandwidth and Average True Range.

Finally, you can add the one ingredient O'Neil completely overlooks: options. Many of the growth stocks he discusses are also active underliers, with relatively tight bid/ask spreads. This can make even more sense because many have very high individual stock prices, like Amazon.com (AMZN) and TSLA.

In conclusion, William O'Neil's How to Make Money in Stocks is an excellent guide for investing in growth stocks. Its collection of charts demonstrates both a deep knowledge and love of stocks. Despite the limitations mentioned above, it's well worth reading — especially in the kind of tech-dominated market we have today.

Advertisement

How To Make Money In Stock By William O Neil

Source: https://www.tradestation.com/insights/2020/08/04/book-review-wiliiam-oneil-how-to-make-money-in-stocks/

Posted by: arledgeetonly.blogspot.com

0 Response to "How To Make Money In Stock By William O Neil"

Post a Comment