34) Can People Earn Money By Playing Online Games Like Second Life ?

United Airlines' extensive network offers incredible opportunities to not only fly all over the world, but also earn and redeem miles. United is one of the largest U.S.-based carriers and a founding member of the Star Alliance, which means you can earn United miles with any of its 25 partner airlines.

The airline's loyalty program is called United MileagePlus and you can enroll for an account here . Crediting all your miles to one airline will help you accumulate rewards quickly. That's just one of the ways you can pile up United miles, and in this post we'll focus on many others.

Below, you will find 34 ways to earn MileagePlus miles, including some lesser-known options so you can maximize your earnings.

1. Sign up for United Airlines credit cards

By far, the best way to earn a lot of United miles quickly is by signing up for credit cards. United is currently offering three personal cards and two business cards. Note that all United cards are issued by Chase, which is important to keep in mind given Chase's 5/24 rule on its credit cards.

Welcome bonuses usually start at 50,000 miles and can reach as high as 100,000 miles. If you see a high welcome offer on a card you're considering, it makes sense to act quickly. All current offers are listed below:

Personal Cards

Best personal card offer: United℠ Explorer Card (annual fee: $0 intro for the first year, then $95 ): Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

United Club℠ Infinite Card (annual fee: $525 ): Earn 100,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

United℠ TravelBank Card (annual fee: $0 ): $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Business Cards

Best business card offer: United℠ Business Card (annual fee: $0 intro for the first year, then $99 ): Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

United Club℠ Business Card (annual fee: $450 ): Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

The ideal choice

If you're just starting out earning United miles, signing up for the United℠ Business Card would provide a nice chunk of miles given the sizable welcome offer.

While this is a business card, you don't have to own a corporation to apply. Do you sell anything on Amazon or Ebay? If so, you may be approved. Input your Social Security number in the field that asks for a business tax ID and type in your home address as your business address.

Don't be discouraged from applying if the income you earn from your hobby business is low. On your application, you'll need to include all income earned, which includes your salary from a full-time job. The lender will evaluate your entire profile, not just the amount you include as your business income.

Nerdy tip: Many people don't consider business cards because they believe they don't actually have a side business. However, this is a common misconception. Although a business card may not work for everyone, if it works for you, it could provide an opportunity to access great travel rewards.

2. Sign up for credit cards that earn Chase Ultimate Rewards® and transfer to United

Another great way to earn United points is by transferring them from Chase Ultimate Rewards® . Points transfer at a 1:1 ratio, and the process is pretty straightforward. You will need a credit card from Chase that earns Ultimate Rewards® points. NerdWallet recommends the following cards:

Personal credit cards

Chase Sapphire Reserve® (annual fee: $550 ): Earn 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

Chase Sapphire Preferred® Card (annual fee: $95 ): Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

Business credit cards

Ink Business Preferred® Credit Card (annual fee: $95 ): Earn 100k bonus points after you spend $15,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Ultimate Rewards® .

If you already have any of the cards mentioned above, you can apply for one of the following no-fee cards with Chase. The cash-back you earn can be combined with earnings from other cards as Ultimate Rewards® points. Having these cards in addition to the premium travel cards is a great way to increase your Chase Ultimate Rewards® point balance.

No-fee personal credit cards

Chase Freedom Flex℠ (annual fee: $0 ): Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening. And earn 5% cash back on grocery store purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the first year.

Chase Freedom Unlimited® (annual fee: $0 ): Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening. And earn 5% cash back on grocery store purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the first year.

No-fee business credit cards

Ink Business Cash® Credit Card (annual fee: $0 ): Earn $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening .

Ink Business Unlimited® Credit Card (annual fee: $0 ): Earn $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

Transferring from Chase Ultimate Rewards® to United

When you're ready to transfer points from Chase to United, log into your Chase account and head over to the Chase Ultimate Rewards® page. From the menu at the top, select Transfer to Travel Partners.

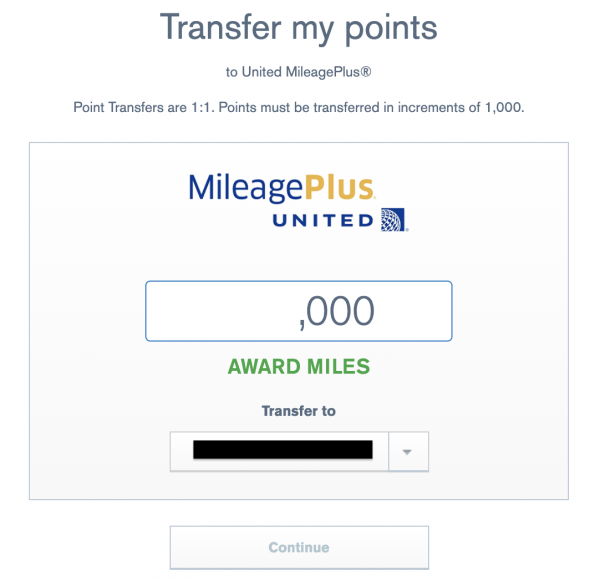

Then, choose United from the choices provided and input your United MileagePlus details. This step will link your United and Chase accounts to allow for future transfers. Once your accounts are linked, you are ready to complete the points transfer.

Points are transferred at a 1:1 ratio and must be transferred in increments of 1,000. Most transfers are instantaneous, which is great because you won't have to worry about an award disappearing while waiting for the points to come in.

3. Sign up for Marriott credit cards and transfer Bonvoy points to United

Although many hotel programs allow you to convert hotel points to airline miles, the conversion ratios are usually weak and not really worth it. In most situations, you'd be better off keeping hotel points in your account and using them for a future stay.

However, Marriott offers a unique transfer ratio of 3:1.1 to United Airlines as part of a special partnership between United and Marriott called RewardsPlus . Under this partnership, when you convert Marriott points to United miles, you will receive 10% more MileagePlus miles in addition to a 5,000-mile bonus for every 60,000 Bonvoy points transferred.

Thus, when you convert 60,000 Marriott points to United, you will receive 27,500 MileagePlus miles. The calculation is as follows:

-

60,000 / 3 = 20,000

-

20,000 + 5,000 = 25,000

-

25,000 * 1.1 = 27,500 United miles total

There are several Marriott Bonvoy credit cards to choose from depending on your travel and spending preferences. NerdWallet recommends the following Marriott Bonvoy credit cards:

-

Marriott Bonvoy Bold® Credit Card (annual fee: $0 ): Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

-

Marriott Bonvoy Boundless® Credit Card (annual fee: $95 ): Earn 3 Free Nights (each night valued up to 50,000 points) after qualifying purchases + 10X total points on eligible purchases in select categories.

-

Marriott Bonvoy Brilliant™ American Express® Card (annual fee: $450 ): Earn 75,000 Marriott Bonvoy bonus points after you use your new Card to make $3,000 in purchases within the first 3 months. Plus, earn up to $200 in Statement Credits for eligible purchases at U.S. Restaurants within the first 6 months of Card Membership. Terms Apply.

-

Marriott Bonvoy Business™ American Express® Card (annual fee: $125 ): Earn 75,000 bonus Marriott Bonvoy points after you use your new Card to make $3,000 in eligible purchases within the first 3 months of Card Membership. Plus, earn up to $150 back in statement credits on eligible purchases made on your new Card within the first 3 months of Card Membership. Terms Apply.

Regardless of which card you go with, if you're using this method, always try to transfer Bonvoy points in increments of 60,000 so you can take advantage of the 5,000-mile bonus. To view rates and fees of the Marriott Bonvoy Brilliant™ American Express® Card , see this page . To view rates and fees of the Marriott Bonvoy Business™ American Express® Card , see this page .

When a transfer makes sense

NerdWallet values Marriott points at 0.7 cent each. As such, 60,000 Marriott points equate to $420. Based on our 1 cent valuation of United miles, 27,500 miles are worth $275. Considering this math, a conversion of Marriott points to United miles does not make a ton of sense.

However, it's important to think about this hotel point transfer in the context of your travel goals. Prospectively transferring Marriott points to United is probably not a good bet. However, if you need to top up your United balance so you can book an award — specifically one in a premium cabin, which often yields a higher redemption value — the transfer may make sense.

Remember that all our valuations reflect a baseline value, drawn from real-world data on hundreds of economy routes, not a maximized value. United miles can be worth significantly more than 1 cent when redeemed for premium cabin seats.

Use American Express to maximize the conversion rate

If you have a United redemption in mind and the timing aligns with a transfer bonus from AmEx to Marriott, you could end up walking away with significantly more United miles after completing a three-way transfer (Amex → Marriott → United).

Nerdy tip: When deciding on a points transfer from Marriott to United, check to see if there are any transfer bonuses going on to maximize your miles.

4. Earn United miles on credit card bonus categories

In addition to earning United miles each time you swipe your United credit card, you can also earn bonus miles on purchases on specified categories.

Four United credit cards earn 2 miles per $1 on United purchases. In addition, each of the cards earn 1.5-2 miles per $1 in the following categories:

| United℠ Explorer Card | United Club℠ Infinite Card | United℠ Business Card | United Club℠ Business Card |

|---|---|---|---|

| 2x on restaurants and on hotel stays. | 1.5x on all purchases. | 2x on local transit and commuting — including train tickets, taxi cabs, mass transit, tolls, rideshare services, gas stations, restaurants and office supply stores. | 1.5x on all purchases. |

Note that the United℠ TravelBank Card earns 2% in TravelBank cash per $1 spent on tickets purchased from United and 1.5% on all other purchases. This card is different from the other cards because it does not earn United miles but instead earns cash back that can be redeemed on United flights only.

The clear winner in terms of most bonus categories at 2x is the United℠ Business Card . If you'd rather earn 2x United miles on hotel stays, the United℠ Explorer Card is the stronger choice.

However, if your overall spend isn't in any of those categories at all and you'd rather earn 1.5x United miles on all purchases and benefit from lounge access, the United Club℠ Infinite Card or the United Club℠ Business Card are the better options.

As always, when deciding which card to sign up for, evaluate your spending habits.

To maximize your earnings, consider using your credit card for most if not all of your purchases, keeping in mind that you shouldn't charge more than you can repay each month. Carrying balances incurs interest that wipes out the value of any rewards.

Many people like to pay in cash when they go out to eat. However, if you're trying to maximize your miles earned, start using a credit card for all restaurant charges. A small adjustment like this will allow you to earn points where a cash payment would not.

Consider a $100 dinner. If you charge that on the United℠ Explorer Card or the United℠ Business Card , you will end up with 200 United miles vs. none if you had paid in cash.

Though this can seem like an inconsequential amount of miles, you'd be surprised how quickly they add up. An extra few hundred miles can be the difference between having enough miles for a dream award seat or being slightly short and needing to do something expensive like purchasing miles to replenish your account.

To maximize bonus categories, we recommend you get into the habit of strategically thinking about which credit cards you use for which purchases.

Nerdy tip: Save a note in your phone showing which credit cards earn bonus miles in specific categories, so you can maximize the number of miles you earn from everyday purchases.

5. Earn United miles on flights

Flying with United, Star Alliance airlines or with United's other airline partners is an easy way to earn MileagePlus miles. First, register for a MileagePlus account . After registration, you will receive your MileagePlus number, which you can add to all future reservations.

Earn miles on United flights and partner airlines with tickets issued by United

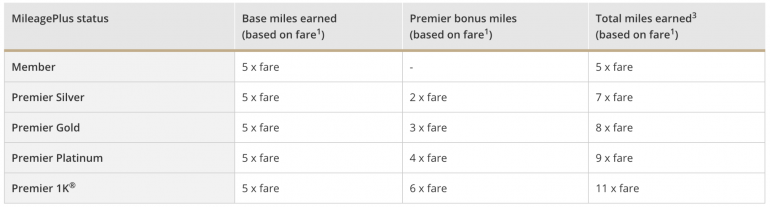

Generally, the number of United miles earned depends on the price of the flight and your elite status level:

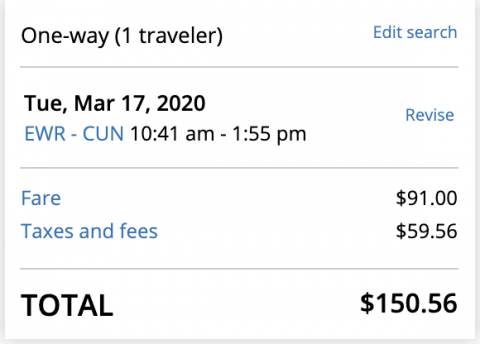

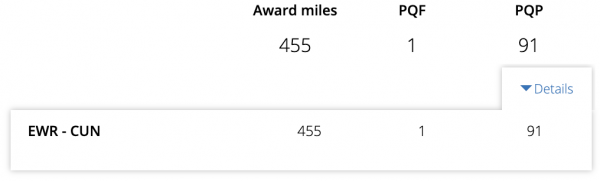

To illustrate how miles are earned, let's take the following example of a $151 one-way flight from Newark to Cancun, Mexico, on March 17, 2020.

United awards miles based on the fare portion only; taxes and fees are unfortunately not included.

If you are a basic member, you will earn 455 redeemable award miles: the $91 fare x a basic member earn rate of 5. This flight will also earn 1 Premier Qualifying Flight (PQF) and 91 Premier Qualifying Points.

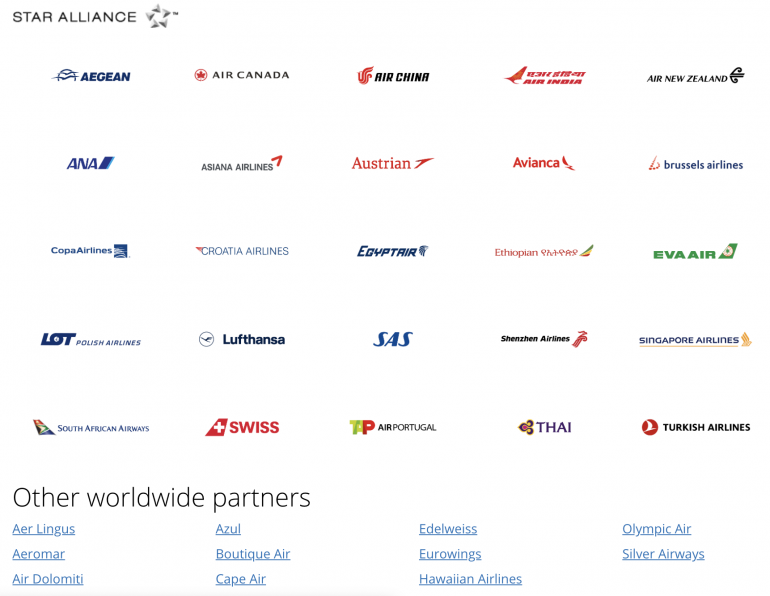

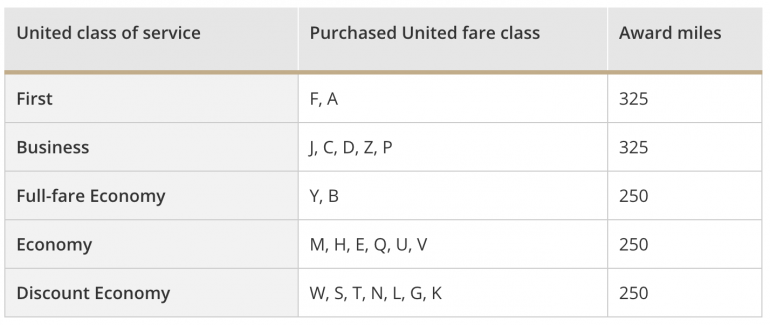

Earning miles on Star Alliance and partner airlines

You can also earn United miles when flying on 37 airline partners , 25 of which are part of Star Alliance. United's membership in the Star Alliance network offers incredible opportunities for earning miles given the extensive coverage provided by the partner airlines.

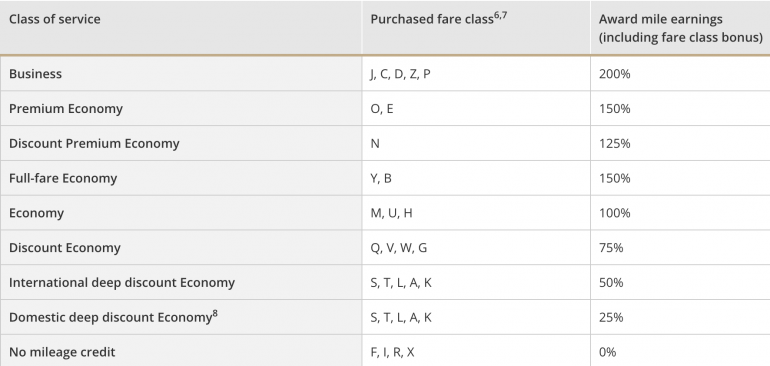

To determine the number of miles earned for each flight, you will need to review each airline's mileage policy. For example, a flight on Air Canada will earn miles based on the following rates:

To calculate the number of United miles earned, multiply the distance flown by the mileage earning percentage that corresponds to your fare class. To illustrate, say you're flying from Toronto to Sao Paulo (5,075 miles) in fare class Q, which correlates to discount economy. Based on a 75% earning rate for that fare class, you will earn 3,806 United award miles for the flight.

Shop online

Earn United miles for shopping online through the airline's MileagePlus Shopping portal.

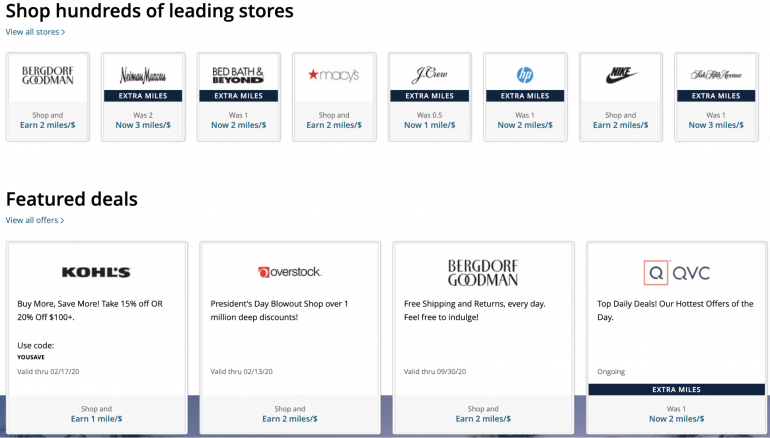

To begin, register for an account using your MileagePlus number. Below you can see the earn rate at various featured merchants (note that these earn rates change often, so you may see different offers):

Upon logging in, search for a store and click on its offer. Once you complete your purchase, the transaction will be recorded.

Clicking through the MileagePlus Shopping portal is a simple way to earn miles for something you would buy anyway. For example, if you're making a $200 purchase at Saks Fifth Avenue, by clicking through MileagePlus Shopping, you'll earn 600 United miles given the 3x earn rate (as shown above). Miles will usually post within three to five days but can take up to 15 days.

Shop in store

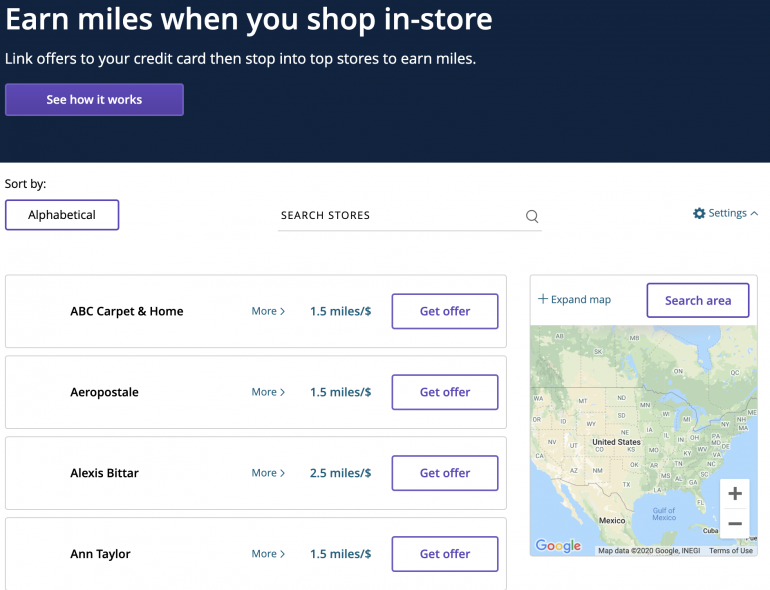

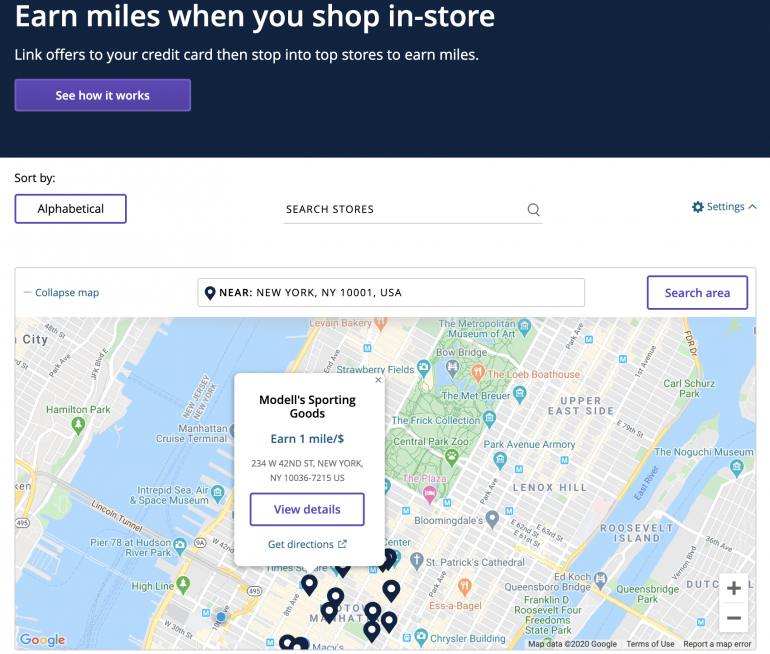

The MileagePlus Shopping portal also lets you earn United miles on in-store purchases. From the MileagePlus Shopping homepage, choose "in-store miles" from the top menu, which will take you to a map of the U.S.

Click on "Expand map" and input your ZIP code. You will then see a list of merchants on a map, which is pretty handy for figuring out if any stores near you are participating.

A sample search of ZIP code 10001 in New York City revealed many participating stores. Click on a store's marker on the map to view the earn rate.

Get a United browser button add-on

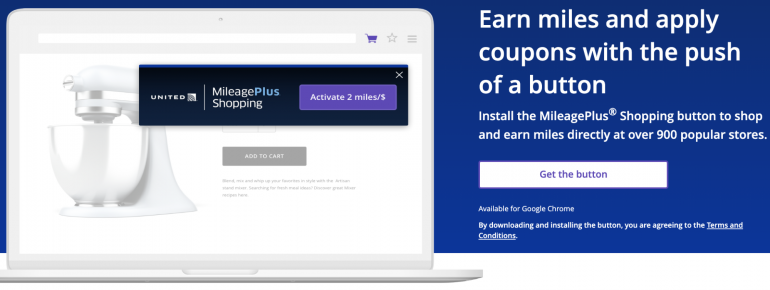

A new feature of the United MileagePlus Shopping mall is the ability to install a shopping button on your Google Chrome browser.

Once the button is installed, each time you visit an online merchant that participates in the MileagePlus Shopping portal, you will get a notification in the top right of your browser informing you of the earn rate.

Click on the purple "Activate" button to record the transaction. This button eliminates the need to visit the shopping portal each time you want to buy something online. This new feature is great for those who want to earn United miles for online purchases but forget to visit the shopping portal beforehand.

Nerdy tip: The MileagePlus shopping mall frequently offers bonuses for spending over a specified amount (usually about $200), so review the site periodically (or install the button) to see if you could earn extra miles.

7. Visit restaurants through MileagePlus dining

United participates in a restaurant program that allows you to earn MileagePlus miles for dining at participating bars, restaurants or clubs. To start earning miles, sign up for a MileagePlus Dining account and add a debit or credit card to your profile.

Even if you don't have a United co-branded credit card, you can use any card you have now. Whenever you visit a participating bar, club or restaurant, use the card in your profile and the miles will post automatically.

If you've never participated in the program, you can usually earn a bonus for signing up.

Currently, United is offering up to 3,000 bonus miles in your first 30 days. MileagePlus cardholders and United Premier frequent flyers can earn 1,500 for their first dining purchase and 500 miles each for three additional ones. If you don't have MileagePlus credit card, you will earn 1,000 miles on your first dine purchase and 500 each for the next three.

The number of United miles earned per $1 depends on your member level. Earnings range from 1 mile per $2 spent (basic members) to 5 miles per $1 spent (VIP members).

Nerdy tip: If you're going out to eat, do a quick search on the MileagePlus Dining website to see if any restaurants near you participate in the program.

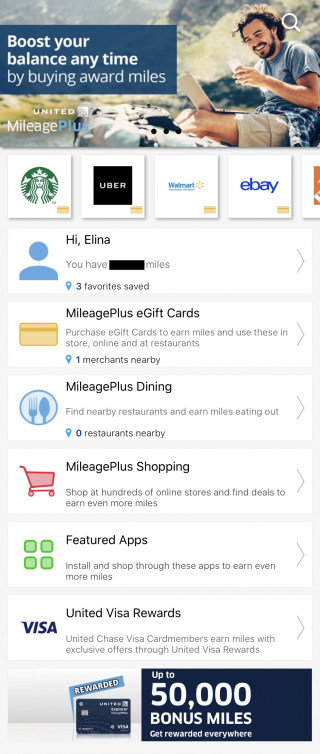

8. Use the MileagePlus X app

Want to earn United miles on the go? The United MileagePlus X app offers an easy way to earn miles from your smartphone.

The app is an easy way to see several ways you can earn extra miles in one location. You'll be able to earn miles on:

-

MileagePlus eGift card purchases.

-

MileagePlus Dining.

-

MileagePlus Shopping.

-

Featured store apps.

If you hold a United credit card, you can earn 25% more miles on purchases of e-gift cards.

9. Transfer points from hotels to United

You can convert hotel points to United miles. This is a great option for those who have hotel points that they don't know what to do with. Although not all the below ratios are as lucrative as the ratio with Marriott (3:1.1), these options can still come in handy.

| Hotel Brand | Transfer Rate |

|---|---|

| IHG | 5 points:1 mile (10,000 points:2,000 miles) |

| Hilton | 10,000 points:1,000 miles |

| Hyatt | 2.5 points:1 mile *Receive a 5,000-mile bonus when you convert 50,000 points into 20,000 miles. |

| Wyndham | 6,000 points:1,200 miles 16,000 points:3,200 miles 30,000 points:6,000 miles |

| Choice | 5,000 points:1,000 miles |

| Golden Circle | 1 point:1 mile *Convert a minimum of 2,500 points |

| Accor | 2,000 points:1,000 miles |

| Radisson | 2,000 points:200 miles 50,000 points:5,000 miles 100,000 points:10,000 miles |

To transfer hotel points, head over to the United hotel partner page and select the hotel you're looking to transfer the points from. Log in to your account on the hotel's website and look for the option to convert your hotel points to United miles.

10. Earn United miles for staying at hotels

United's hotel partners

At many hotels, you can earn United miles instead of hotel points when staying. Below is a list of hotels that let you earn United miles instead of hotel points, as well as the earning rate.

Usually, it's not possible to earn both hotel points and airline miles with these partners, so a choice will have to be made. There's no right or wrong answer; it really depends on your preferences and how relevant hotel points may be to your travels.

| Chain | Hotel Name | Earn Rate |

|---|---|---|

| Best Western | Best Western, Ascend Hotel Collection, Cambria Suites, Clarion, Comfort Inn, Comfort Suites, Econo Lodge, MainStay Suites, Quality Inn, Rodeway Inn, Sleep Inn, Suburban Extended Stay Hotel | 250 miles per stay. MainStay Suites earn 250 miles per stay in the U.S., Canada, Mexico, the Caribbean and Europe (excluding Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden). |

| Fiesta | Fiesta Americana | 2,000 miles per stay, minimum stay 2 nights. |

| Hyatt | Andaz, Grand Hyatt, Hyatt Centric, Hyatt Hotels & Resorts, Hyatt House, Hyatt Place, Hyatt Regency, Hyatt Zilara, Hyatt Ziva, Park Hyatt Hotels, Unbound Collection | 500 miles per stay. |

| IHG | Candlewood Suites, Crowne Plaza Hotels & Resorts, Holiday Inn Express, Holiday Inn Hotels & Resorts, Hotel Indigo, IHG, Staybridge Suites | Candlewood Suites and Staybridge Suites earn 1 mile for every $1 spent. All other IHG properties earn 2 miles per $1 spent. |

| Langham | Cordis Hotels and Resorts, The Langham Hotels and Resorts, Eaton HK | 500 miles per night up to 1,500 per stay. Eaton HK earns 250 miles per night up to 750 miles per stay. |

| Marriott | AC Hotels by Marriott, aloft, Courtyard by Marriott, Element by Westin, Fairfield Inn by Marriott, Four Points by Sheraton, Marriott Executive Apartments, Moxy Hotels, Protea Hotels, SpringHill Suites by Marriott | 1 mile for every $1 spent. |

| Marriott | Autograph Collection Hotels, Delta Hotels, Design Hotels, EDITION, JW Marriott Hotels & Resorts, Le Meridien, Marriott Hotels & Resorts, Marriott Vacation Club, Renaissance Hotels & Resorts, Residence Inn by Marriott, Sheraton Hotels & Resorts, St. Regis Hotels & Resorts, The Luxury Collection, The Ritz-Carlton, W Hotels, Westin Hotels & Resorts | 2 miles for every $1 spent. |

| Millenium | Millennium Hotels and Resorts | 500 miles at Millenium and 250 miles at Copthorne properties. |

| Shangri La | Kerry Hotels, Shangri-La Hotels & Resorts, Traders Hotels | 500 miles per stay. |

| Wyndham | AmericInn by Wyndham, Baymont by Wyndham, Days Inn by Wyndham, Dazzler by Wyndham, Dolce Hotels and Resorts by Wyndham, Esplendor Boutique Hotels by Wyndham, Hawthorn Suites by Wyndham, La Quinta by Wyndham, Microtel by Wyndham, Ramada by Wyndham, Super 8 by Wyndham, Trademark Collection by Wyndham, Travelodge by Wyndham, TRYP by Wyndham, Wingate by Wyndham, Wyndham, Wyndham Garden, Wyndham Grand | Wyndham Rewards Blue and Gold Members earn 1 mile for every $1 spent per stay; Wyndham Rewards Platinum and Diamond Members earn 2 miles for every $1 spent per stay. |

Rocketmiles and PointsHound

You can also earn United miles by booking hotels through PointsHound and Rocketmiles. These two booking sites allow you to earn from 1,000 to 10,000 points per night depending on the hotel. Generally, the more expensive the hotel, the more points you can earn per night.

However, it's important to note that the cost of a stay booked with either of these sites can be more expensive than with other online travel agencies (likely due to a premium charged for earning lots of United miles). So keep this in mind when shopping around for a hotel.

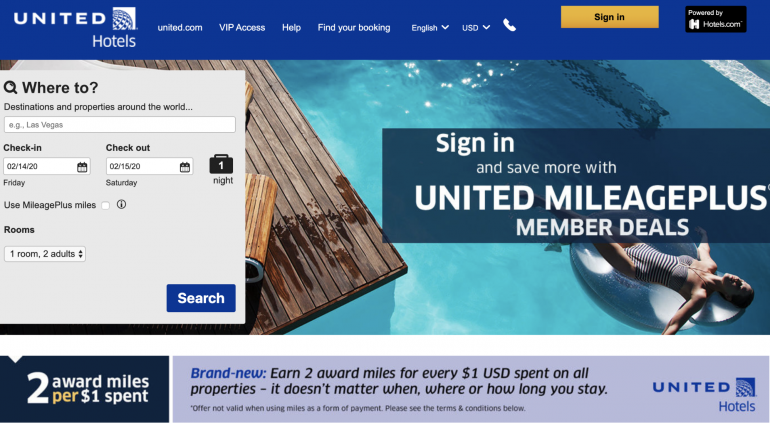

United Hotels

You can also earn United miles when you book a hotel through United's hotel portal, which lets you earn 2 miles per $1 spent (and sometimes offers special earning opportunities).

This could be a great option in these cases:

-

You'd like to earn United miles and hotel points for your stay.

-

The hotel you'd like to stay at isn't listed as an earning partner in the list above.

-

The hotel you'd like to stay at is an earning partner, but the miles earned from your stay when booked through United Hotels exceed the miles you would earn based on the hotel partner chart above.

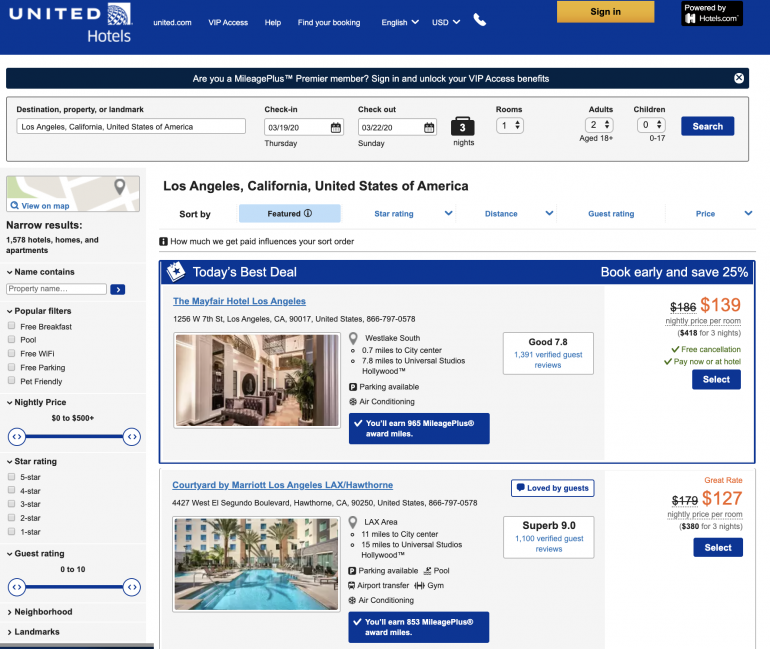

The example below shows how a three-night stay from March 19-22, 2020, in Los Angeles is seen on the United Hotels site:

Mayfair Hotel in Los Angeles

When we checked, staying at the Mayfair Hotel would earn 965 MileagePlus miles if booked through the United hotel portal. This hotel isn't one of the partner hotels listed in the chart above, so booking through the United Hotel site is a great way to earn United points on your booking.

Courtyard by Marriott Los Angeles LAX/Hawthorne

Another example where the United Hotel site wins is illustrated at this property. You will earn 853 United miles for this booking in addition to any Marriott Bonvoy points that you can earn (based on your elite status with Marriott).

This option results in a much better rate than if you were to book the hotel through United's partner link to Marriott, which would only earn 1 United mile per $1 spent (or 380 United miles) at Courtyard hotels and no Marriott points.

Nerdy tip: Before making your hotel reservation, check the MileagePlus shopping mall to see if there is an opportunity to earn United miles on your booking with the hotel or online travel agency. For example, we found the MileagePlus Shopping mall running a promo that earned 3 miles per $1 spent at Booking.com. If Booking.com has a cheaper price than the United Hotel site, this option might be an even better idea. And of course, this earn rate is in addition to any hotel points you'd earn on the booking.

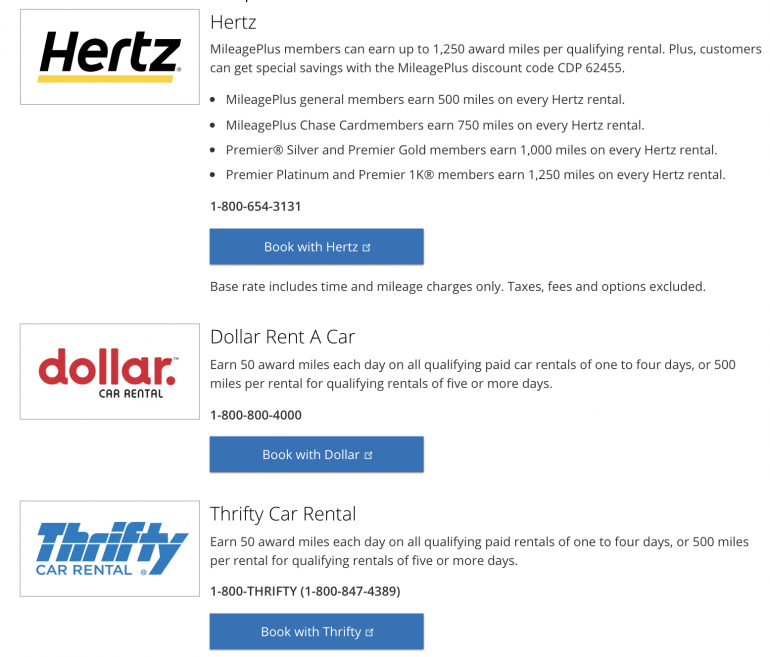

11. Book car rentals

United has partnerships with three car rental companies that allow you to earn United miles for rentals . Participating companies include Dollar, Hertz and Thrifty.

To earn United miles, click "Book now" on the rental company you'd like to book with and input any relevant discount codes.

Nerdy tip: Review your printed rental agreement to ensure your MileagePlus number is included so you can earn these miles.

12. Explore the U.S. on Amtrak and earn United miles

Amtrak operates trains that travel to over 500 destinations in the U.S. The company also runs the Acela Express, which is a high-speed train that runs between New York, Boston, Washington, D.C., and cities in between.

If you'd prefer to take a train instead of flying to your final destination, you can earn some airline miles if you connect from Newark airport to certain Amtrak stations. United miles can be earned on your Amtrak segment based on which airfare class you purchased for your connection:

Here are the stations you must connect to by train from Newark to earn these miles:

-

New Haven Rail Station, Connecticut.

-

Stamford Rail Station, Connecticut.

-

Philadelphia 30th Street Station, Pennsylvania.

-

Wilmington Rail Station, Delaware.

In addition, business class and first-class tickets on Acela Express trains between New York's Penn Station and Boston's South Station, Boston's Back Bay Station, Boston's Route 128 Station, or Washington, D.C., will earn 500 miles and 750 miles, respectively.

Nerdy tip: Remember to input your MileagePlus number when making the Amtrak reservation to ensure you earn miles.

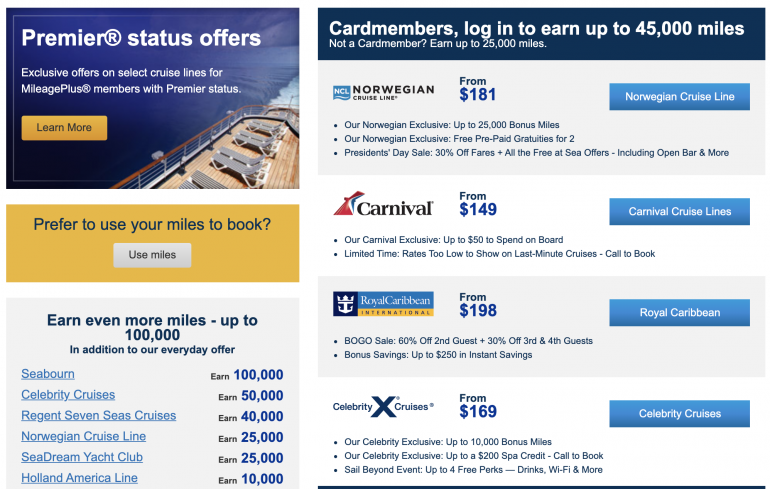

13. Go on a cruise

If you love cruises, United has a cruise booking platform that lets you earn MileagePlus miles for taking a cruise. There are always various promos going on, especially for United cardholders, so taking a cruise could end up earning you lots of MileagePlus miles.

At the time of this writing, United cardmembers could earn up to 45,000 miles per booking, which is a pretty sweet deal.

Nerdy tip: United Cruises offers a 110% best price guarantee. If you see a lower price on another website within 48 hours of booking, contact United Cruises to get a 110% refund of the price difference.

14. Use Timeshifter - The Jet Lag App

Hate jet lag? We do too.

United has partnered with the Timeshifter app, which claims to incorporate the latest sleep research to help you beat jet lag. A purchase of an annual subscription will earn 500 United miles, while a roundtrip plan will earn 200 miles.

15. Get identity protection from LifeLock with Norton

LifeLock with Norton offers protection for your identity and electronic devices. You can earn up to 13,000 United miles and get 35% off your first year's subscription when signing up for identity theft protection.

Nerdy tip: When you're thinking of signing up for any type of service or purchasing anything online (e.g., energy service, cell phone provider, flowers, etc.) do a search to see if your preferred airline is offering miles with the specific vendor. You never know when you can pick up some additional miles.

16. Purchase flowers

Buying flowers is another way to pick up a lot of MileagePlus miles. United partners with these three online flower shops (offers may change):

-

FTD : 20 United miles per $1 spent on flowers and gifts.

-

Teleflora : 750 United miles per order. Use promo code BALP56.

-

1-800-Flowers : 15 United miles per $1 spent on flowers and gifts. Use promo code MP56.

17. Take online surveys with e-Rewards and Opinion Miles Club

Although this is an uninteresting way to earn United miles, if you have some time to kill, consider taking some surveys.

United partners with e-Rewards and Opinion Miles Club , both of which award United miles for completing surveys. Opinion Miles Club is offering at least 300 MileagePlus miles for signing up and taking your first survey. Even if you complete only one survey, 300 miles for 10 minutes of your time isn't a bad deal.

To start earning miles, sign up for an account with either or both companies and fill out a questionnaire to find out which surveys you are eligible for.

18. Order gourmet gifts from Harry & David

You can earn 30 United miles per $1 when shopping at Harry & David, a premium food and gift retailer. These baskets are great for office parties. If you're thinking of purchasing a nice gourmet food gift for an event, jumping on this offer can be a great way to pick up some United miles.

19. Exchange money with Travelex

If you're going on a trip and need to exchange money in advance (or just want to lock in an exchange rate), you can do so with Travelex and earn United miles for the transaction. Travelex allows you to earn up to 3,000 United miles when exchanging money in advance. You will earn 1 mile per $1 on exchanges over $500, and 1 mile per $2 on exchanges under $500.

When traveling internationally, ATM fees and commissions on money exchanges can add up. The best combo for saving money on foreign currency withdrawals is having an account with a bank like Charles Schwab, which waives foreign ATM fees , and avoiding money exchanges, which usually have poor exchange rates and high fees. However, if your bank doesn't waive ATM fees, then using a cash exchange like Travelex could make sense, especially if you can pick up some United miles along the way.

20. Purchase wine with Vinesse

You can earn 5,000 United miles plus 5 miles per $1 spent when you sign up for Vinesse, an online wine club. The bonus is paid over two shipments: 2,000 miles after your first shipment and 3,000 miles after your second shipment.

If you're a United Premier elite or have a United credit card, you are eligible to earn even more miles. Vinesse is currently offering a 6,500 miles sign-up bonus, with 2,500 miles awarded on your first shipment and 4,000 miles awarded on your second shipment. All purchases thereafter earn 7 miles per $1 spent.

21. Shop on MyPoints

MyPoints is a shopping portal that lets you earn points, which can be redeemed for gift cards or airline miles. If you join through United, you can earn up to 1,500 United miles. You will get 500 MileagePlus miles for signing up and activating your MyPoints account and 1,000 miles after making your first purchase of $25 or more within 30 days.

If you shop online already and MyPoints has the store you're looking for, taking advantage of this offer is an easy way to pick up 1,500 United miles.

22. Order travel documents from VisaCentral

If you need to order travel documents such as a passport or visa for an international trip, you can do so with VisaCentral and earn United miles while you're at it.

You can earn 1,000 MileagePlus miles for visa and passport services and 500 miles for Australian Electronic Travel Authority and U.S. Electronic System for Travel Authorization services. VisaCentral's services are available in the U.S., Canada, Australia and the United Kingdom.

23. Donate to charity

24. Purchase tickets to Broadway plays

Audience Rewards is Broadway's official loyalty program. Through United's partnership with Audience Rewards, you could earn up to 100 United miles per ticket, with bonus offers up to 2,000 miles.

25. Order meals with Home Chef

Home Chef offers weekly customized meal kits delivered to your door. If you sign up through United , you could earn 1,000 miles on each of your first five orders for a total of 5,000 United miles. The offer is only available to residents of the continental U.S.

26. Take out a home loan through Quicken Loans

Quicken Loans is a loan and mortgage company. Through an offer with United, you can earn 25,000 MileagePlus miles for closing or refinancing a home through Quicken Loans.

If you're planning on borrowing for a home purchase or refinancing your mortgage, look around to find the best rate available. Earning miles for such an important financial decision is a cherry on top, not the main factor. However, if you see that your rate available from Quicken Loans is the best out there, then taking advantage of this offer is a great way to earn 25,000 United miles.

27. Take out a business loan from MerchantRefi

If you're looking for a business loan, MerchantRefi is offering MileagePlus members the opportunity to earn 10,000 United miles. To qualify, you must complete a questionnaire and be approved for a qualifying advance.

28. Get auto insurance from California Casualty Auto and Home Insurance

If you switch your auto insurance company to California Casualty Auto and Home Insurance , you can earn up to 20,000 United miles. The earnings are staggered, so if you want to earn the full 20,000 miles, you will need to keep coverage for three policy renewal periods.

The offer is not valid for residents of New York, Massachusetts, Alaska, Michigan, Hawaii, North Carolina or Wisconsin.

29. Purchase a Mercedes

If you plan to purchase a new vehicle, you can earn 25,000 to 35,000 United miles when you purchase or lease select Mercedes-Benz cars. Before heading to the dealership, fill out the form on the website and activate your control number. Bring the form and control number with you to the dealership to benefit from the MileagePlus bonus offer.

30. Use energy providers NRG or Reliant

Earn United miles for signing up with energy suppliers NRG or Reliant.

You can earn up to 10,000 United miles, plus 2 miles per $1 spent when you sign up with NRG Home. MileagePlus cardmembers can earn an additional 2,500 MileagePlus miles and an ongoing rate of 3 miles per $1 spent.

If you live in Texas, you have the option of using Reliant. You can earn 15,000 United miles when you switch your utility provider to Reliant plus an extra 500 MileagePlus miles for each month you're registered (for the next 24 months).

Make sure to read each provider's terms and conditions. Independent energy providers can offer electricity at variable rates, which can introduce volatility into your monthly bill.

31. Buy a home security system through SimpliSafe

SimpliSafe is a supplier of home security systems, and you can earn up to 7,000 United miles when you buy a home security system from this company. If you're looking to purchase a security system for your home, United's partnership with SimpliSafe makes it easy to do so.

32. Book car service with Sixt, Carmel or Execucar

United is currently offering the opportunity to earn bonus miles with three car-service companies, Sixt, Carmel and Execucar.

-

Sixt mydriver is offering 3 United miles per $1 spent on car rides.

-

Carmel is offering a bonus of 50 MileagePlus miles on rides within New York or 100 MileagePlus miles on rides outside of New York. In addition, all rides can earn up to 2 United miles per $1 spent when booked online.

-

ExecuCar is offering 150 United miles for one-way trips, and 300 United miles on round-trip rides when booking a black car.

Given that all of these car companies are U.S.-based, they compete for customers with Lyft and Uber. In this case, it may make sense to shop around to make sure you're getting the best bang for your buck. Uber offers benefits to holders of the The Platinum Card® from American Express , while Lyft has a new partnership with the Chase Sapphire Reserve® . Terms apply.

33. Book an airport shuttle

SuperShuttle offers shuttle service to and from airports; you can earn 50 United miles for every one-way ride or 100 miles round-trip. SuperShuttle operates in 71 domestic and 16 international locations.

34. Purchase United MileagePlus miles

Although buying miles is a way to earn United miles, it generally ought to be your last resort given how expensive they are.

-

Padding your account to book an award flight.

-

Buying miles to book a first- or business-class award that is cheaper to book with miles than buying a cash ticket.

-

Buying a small number of miles to keep your miles from expiring.

If you need to buy miles, try to align the timing with an airline promo so you can get miles for a discount.

NerdWallet values United miles at 1 cent each, so keep this in mind when considering a miles purchase. Even in instances where you can purchase United miles for less than 1 cent , we've provided so many better (and cheaper) ways to earn MileagePlus miles that buying them should only occur when there's no cheaper option available.

Frequently asked questions

The easiest way to earn United miles is to sign up for a credit card that earns United MileagePlus miles. You can also earn United miles by flying on United, its partner airlines and Star Alliance carriers. If you have points with Chase Ultimate Rewards® or Marriott, you could transfer those points to United.

Yes, passengers earn miles on basic economy tickets in the same way as they would on standard economy tickets. However, basic economy tickets are the most restrictive as they are nonrefundable and unchangeable, so keep that in mind when making a booking.

No. The passenger who flies is the one who earns the miles, not the person who purchases the ticket.

United uses dynamic pricing, so the cost of a flight in miles can fluctuate based on the travel date and airline partner. However, United publishes flight award deals , allowing you to purchase an award ticket for as little as 5,000 United miles.

No, United miles do not expire.

The bottom line

United makes it really easy to earn MileagePlus miles in so many different ways. The quickest way to get a head start is by earning credit card welcome offers and using the credit cards for everyday spending.

Beyond that, consider which of these mileage earning opportunities apply to you and try to incorporate them into your daily routine. Earning miles in some of these random ways can be great for padding your United account and bringing you one step closer to your dream trip.

What's your favorite way to earn United miles? Have you earned United miles in ways not listed above? Tell us below in the comments.

The information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

To view rates and fees of the Marriott Bonvoy Brilliant™ American Express® Card , see this page .

How to maximize your rewards

You want a travel credit card that prioritizes what's important to you. Here are our picks for the best travel credit cards of 2021 , including those best for:

34) Can People Earn Money By Playing Online Games Like Second Life ?

Source: https://www.nerdwallet.com/article/travel/ways-to-earn-united-mileageplus-miles

Posted by: arledgeetonly.blogspot.com

0 Response to "34) Can People Earn Money By Playing Online Games Like Second Life ?"

Post a Comment